Massachusetts Sales Tax Exemption For Manufacturers . While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if.

from www.exemptform.com

Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state.

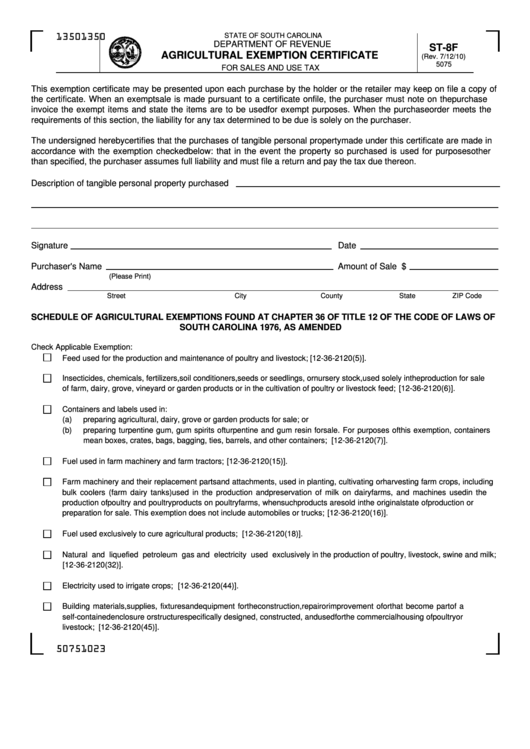

Agricultural Tax Exempt Form For Property Tax

Massachusetts Sales Tax Exemption For Manufacturers To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Agencies of the united states (sales made. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. Sales and use tax exemption, the exemption from sales and use tax for the sale. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to.

From www.formsbank.com

Form St5 Sales Tax Exempt Purchaser Certification Massachusetts Massachusetts Sales Tax Exemption For Manufacturers To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. Agencies of the united states (sales made. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities. Massachusetts Sales Tax Exemption For Manufacturers.

From www.formsbank.com

Form St5 Sales Tax Exempt Purchaser Certificate Massachusetts Massachusetts Sales Tax Exemption For Manufacturers Sales and use tax exemption, the exemption from sales and use tax for the sale. Agencies of the united states (sales made. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they. Massachusetts Sales Tax Exemption For Manufacturers.

From www.pdffiller.com

Fillable Online Printable Massachusetts Sales Tax Exemption Massachusetts Sales Tax Exemption For Manufacturers Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many. Massachusetts Sales Tax Exemption For Manufacturers.

From www.dochub.com

St 12 Fill out & sign online DocHub Massachusetts Sales Tax Exemption For Manufacturers Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. While massachusetts' sales. Massachusetts Sales Tax Exemption For Manufacturers.

From www.dochub.com

Massachusetts resale certificate Fill out & sign online DocHub Massachusetts Sales Tax Exemption For Manufacturers Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt. Massachusetts Sales Tax Exemption For Manufacturers.

From www.exemptform.com

Ma Sales Tax Exempt Purchaser Certificate Form St 5 Milton Academy Massachusetts Sales Tax Exemption For Manufacturers Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. 64h,. Massachusetts Sales Tax Exemption For Manufacturers.

From forms.utpaqp.edu.pe

Types Of Sales Tax Exemption Certificates Form example download Massachusetts Sales Tax Exemption For Manufacturers Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Sales and use tax. Massachusetts Sales Tax Exemption For Manufacturers.

From massachusetts.salestaxeducators.com

Massachusetts Sales Tax Exemptions Book for Manufacturers Massachusetts Sales Tax Exemption For Manufacturers While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. To take advantage of the sales. Massachusetts Sales Tax Exemption For Manufacturers.

From www.exemptform.com

Agricultural Tax Exempt Form For Property Tax Massachusetts Sales Tax Exemption For Manufacturers Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, including. Massachusetts Sales Tax Exemption For Manufacturers.

From propertytaxrate.blogspot.com

Massachusetts Estate Tax Rates Table Massachusetts Sales Tax Exemption For Manufacturers 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. Agencies of the united states (sales made. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state.. Massachusetts Sales Tax Exemption For Manufacturers.

From www.formsbank.com

Form St5 Sales Tax Exempt Purchaser Certificate Filing Example Massachusetts Sales Tax Exemption For Manufacturers To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Sales and use tax exemption, the exemption from sales and use tax for the sale. Agencies of the united states (sales made. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. 64h, §. Massachusetts Sales Tax Exemption For Manufacturers.

From www.vrogue.co

Resale Tax Form Certificates For All States Printable vrogue.co Massachusetts Sales Tax Exemption For Manufacturers Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt from sales tax if. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. To take advantage of the sales tax exemption. Massachusetts Sales Tax Exemption For Manufacturers.

From www.vrogue.co

What Is Form M 4 2022 Massachusetts Employee S Withholding Exemption Massachusetts Sales Tax Exemption For Manufacturers Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: To take advantage of the sales. Massachusetts Sales Tax Exemption For Manufacturers.

From tutore.org

Massachusetts Resale Certificate Master of Documents Massachusetts Sales Tax Exemption For Manufacturers 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. Agencies of the united states (sales made. While massachusetts' sales tax generally applies to most transactions, certain items have special treatment in many states when it comes. Massachusetts Sales Tax Exemption For Manufacturers.

From franchise-faq.com

How To Fill Out A Texas Franchise Tax Form Massachusetts Sales Tax Exemption For Manufacturers Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Agencies of the united states (sales made. Sales and use tax exemption, the exemption from sales and use tax for the sale. Materials, tools, fuels and machinery, and replacement parts, used directly and exclusively in manufacturing are exempt. Massachusetts Sales Tax Exemption For Manufacturers.

From pafpi.org

Profiles Archives PAFPI Massachusetts Sales Tax Exemption For Manufacturers 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. While massachusetts' sales tax generally. Massachusetts Sales Tax Exemption For Manufacturers.

From www.templateroller.com

Form M4 Fill Out, Sign Online and Download Printable PDF Massachusetts Sales Tax Exemption For Manufacturers Agencies of the united states (sales made. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations that are: To take advantage of the sales tax exemption in massachusetts, you’ll need to complete massachusetts department of revenue form. Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they. Massachusetts Sales Tax Exemption For Manufacturers.

From www.templateroller.com

Form ST8 Fill Out, Sign Online and Download Printable PDF Massachusetts Sales Tax Exemption For Manufacturers Materials, tools, fuels and machinery, including spare parts, used in manufacturing are exempt from sales tax if they become components of a. Massachusetts has long provided tax benefits to corporations that are engaged in manufacturing activities within the state. Agencies of the united states (sales made. 64h, § 6 (d) and (e) provide an exemption from sales tax for organizations. Massachusetts Sales Tax Exemption For Manufacturers.